NADCA was asked to send two representatives to the Metef-Foundeq Expo in Brescia, Italy on April 14-17, since the European community has a strong interest in what is happening in North America. Leonard Cordaro (president, Premier) and Eric Treiber (president, Chicago White Metal Casting) attended the conference, representing NADCA.

This Expo, held every other year, is a combined effort with Metef (International Aluminum Exhibition) and Foundeq Europe (International Foundry Equipment Exhibition). The expo focuses on aluminum only, and includes extruding, die casting, foundries, as well as other ancillary industries such as machining, welding, metal finishing and rolling.

Here is the report from Cordaro and Treiber.

Current European Economic Conditions

We met with many exhibitors to get their take on the European economy in general and the Italian economy specifically. Business is still off considerably from several years ago. 2009 was the low point for most, and just in this past quarter, they have started to see signs of light at the end of the tunnel. The declines have stopped, and while growth is being seen, it is often very slow. We did speak with one Italian machine builder in particular who indicated that Q1 2010 sales equaled all of 2009. His strongest markets right now, however, are Brazil and Russia.

The European community had its own version of “Cash for Clunkers” last fall. This program had the same effect on business overall as it did in the U.S., but now that the program has ended, some are concerned as to whether the recovery will continue. The other wild card is the issue with Greece and what will happen to the Euro as a result of the crisis.

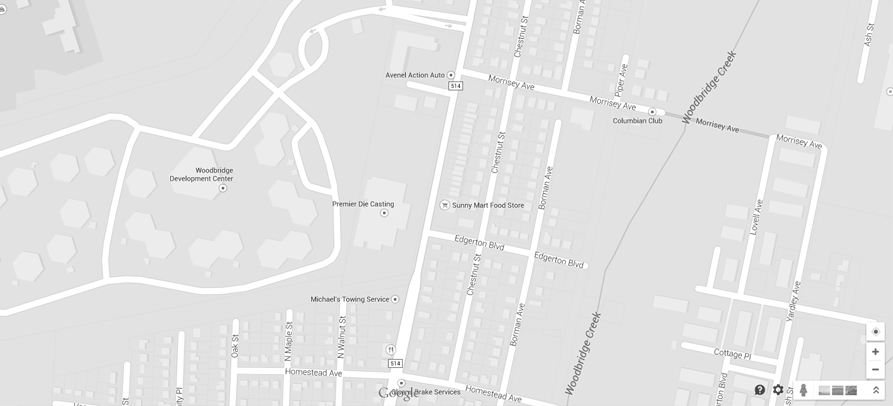

During our visit, the Greek economy issue was just starting to unfold. We were provided with some excellent insight into the Italian die casting industry. More than 100 high-pressure die casters are in the Brescia area alone. This very tight concentration geographically occurred years ago due to the proximity of several machine builders (i.e., Idra, Italpresse, Colosio) who are also located in Brescia.

Twenty percent of the die casters are medium- to large-sized companies, similar to what you would encounter in the U.S. The other 80% are literally “mom and pop” operations that operate one (maybe two) machines out of a garage, basement, shed, etc. These small businesses often employ just a couple people. During better times, these small shops survived by running the overflow work from the medium/large casters.

In recent years though, little to no overflow work has been available, so the number of small shops is decreasing. Sometimes, they are absorbed by a larger caster, they close up shop or they may sell their equipment to an Eastern Block company (eg. Poland, Hungary, Romania) and then work as a consultant, offering their years of experience to assist those who are not as technologically advanced. Even the smallest Italian die casters are technologically advanced and commonly employ robotics and other automation technologies for all aspects of the operation. The move toward full automation began in the mid-1980s and continued until recent times.

Two reasons exist for the high use of automation with Italian die casting companies. For the very small businesses, the owner (and often times sole employee) of the business would be tied to his machine for the entire day, unable to perform other needed activities, without employing such technologies.

A second, and equally important, reason is that Italian employment laws are very strict with respect to layoffs. It is nearly impossible to separate with an employee, even in the most difficult of economic times. Therefore, the approach has always been to automate whenever and wherever possible.

During our tour of the show, we encountered several toolmakers who were exhibiting. Many of the tool shops were supporting the automotive industry, and due to the use of automation, significant capital was spent up front, directed towards making dies that are robust and capable of high volume production with robots. The concept of automation even included the trim die station — most of the automated cells included a robot extracting and die trimming, which meant the trim dies had to be constructed for that purpose. Again, this move to a fully automated die casting cell resulted from the need to minimize direct labor to avoid layoffs of trained workers during a downturn.

Many of the shops had one die cast operator managing three automated cells, so direct labor was much less a concern than the cost of capital employed to purchase such a cell. Since fuel is much more expensive in Europe than the U.S., we also reviewed the status of melting and holding methods. Many of the furnace producers had a version of a stack melter on display along with some melter/holder combination furnaces. It was common for all manufacturers to tell you how many cubic meters of gas-per-kilogram their furnace consumed. All furnaces at the show were delivered with a gas meter included so the die caster could monitor gas consumption long after the furnace was delivered.

We asked several exhibitors what is the greatest threat facing die casters in Italy. The answer came back consistently: competition from Eastern Block companies. This is the biggest threat, more so than China, for an Italian die caster, because these sources are literally in their backyard. There was a time when northern Italy was the low-cost producer for Germany. But today, Poland, Hungary, Romania, etc., are undercutting them. The threat of China and other LCR countries still looms large, but the ability for customers to relocate business to neighboring countries with lower cost structures is much easier, and thus more of a threat. Our equivalent in the U.S. to this threat would be our neighbors to the south, Mexico.

With that said, we also heard that recently some movements are happening to bring work back from these LCR’s due to quality issues. This is similar to what we are slowly starting to see in the U.S. as well. We met with a major supplier of aluminum alloy to gain some insights on their current situation. In regards to market conditions, the smelters are experiencing a shortage of scrap which is affecting pricing and availability. Chinese sources are stockpiling the inputs needed, and with recent increases in demand, supplies are very tight.

Based on discussions with U.S. aluminum suppliers during CastExpo‘10 in Orlando, it appears that we are facing the same struggles as the European smelters. Overall, the European manufacturing community appears to be slowly pulling out of the global economic recession. They have seen increased activity over the past two quarters. While some are bullish on 2010 and beyond, a good percentage are employing a more conservative business strategy.

Metef-Foundeq Exhibition Assessment

Approximately 500 exhibitors were spread across six halls. Three of the halls were specific to die casting. The other three housed extrusions, finishing/machining/rolling/welding and foundry suppliers. The layout was very “attendee-friendly.” We didn’t need to wander through each hall looking for the die casting exhibitors. Each hall focused on specific manufacturing technologies.

Over the four days of the exhibition, a total of 17,000 people attended. The atmosphere, ambiance and aesthetics were much different than our shows in North America. The exhibits for the most part were very dynamic, eye catching and even “sexy.” At our recent CastExpo in Orlando, the majority of exhibitors had the smallest booth space, perhaps some signage on the back curtain and samples/literature displayed on a table. At Metef-Foundeq, we saw only a handful of exhibitors with that minimal layout. The vast majority instead had exhibits similar in size to our largest CastExpo participants.

In addition to colorful and well-lit exhibits, most had comfortable furniture where suppliers and potential customers relaxed and talked. And, nearly every exhibitor had food, beer and wine. And this was not nachos and potato chips. We’re talking fine Italian meats, cheeses, bread, premium beer, sparkling wine, etc. We could sense a completely different approach/business model than what we see at our shows. The best description we can offer is that the suppliers were saying, “Welcome to my home (business). Let us first become friends, and then we can talk shop.”

Many of the exhibitors commonly employed personnel that performed the role of a wait staff, such as you would have in a restaurant. These associates would offer food and drinks to the potential clients while business discussions ensued. It was also quite common for the exhibitors to employ young, female associates, very smartly attired, as a means to attract would-be clients to their booths. While it is duly noted that the marketing tactics of one culture do not necessarily translate to a successful model for another culture, we definitely sensed a more upbeat mood overall, and it certainly was not due to the economy.

The use of “props” and technology in general was much more prevalent. For example, several metal suppliers had bundles of shiny ingots positioned throughout their exhibits. It was very appealing to the eye and really made the booth stand out visually. Some of our larger exhibitors reading this might say, “Wait a minute. We had a grand exhibit in Orlando. We brought several machines, etc.” The difference at Metef was that nearly all the exhibitors had something unique going on beyond a simple booth with a tabletop displaying samples and literature. In short, a far greater effort was made towards the marketing side which made a visit to the show very appealing and a real “social experience.”

The show was located in the heartland of the foundry industry, which made it very accessible to shop employees who we saw in great numbers. This is perhaps something that NADCA and AFS should take into consideration for the future. In fact, we were told that many die casters/foundries closed up on Friday afternoon so their employees could attend the show. In addition, Saturday, the final day of the exhibition, had extremely high traffic as many production personnel used that day to attend.

Overall, the experience was well worth it, even though our return home was delayed five days due to volcanic ash closing European airspace. Not a bad place to be stranded.